Condo Insurance in and around Auburn

Welcome, condo unitowners of Auburn

Condo insurance that helps you check all the boxes

Condo Sweet Condo Starts With State Farm

Are you stepping into condo ownership for the first time? Or have you been a condo owner before? Either way, it can be a good time to get coverage for your condo unit with State Farm's Condo Unitowners Insurance.

Welcome, condo unitowners of Auburn

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

With this coverage from State Farm, you don't have to be afraid of the unforeseen happening to your unit and personal property inside. Agent Kelli Southern can help lay out all the various options for you to consider, and will assist you in building an excellent policy that's right for you.

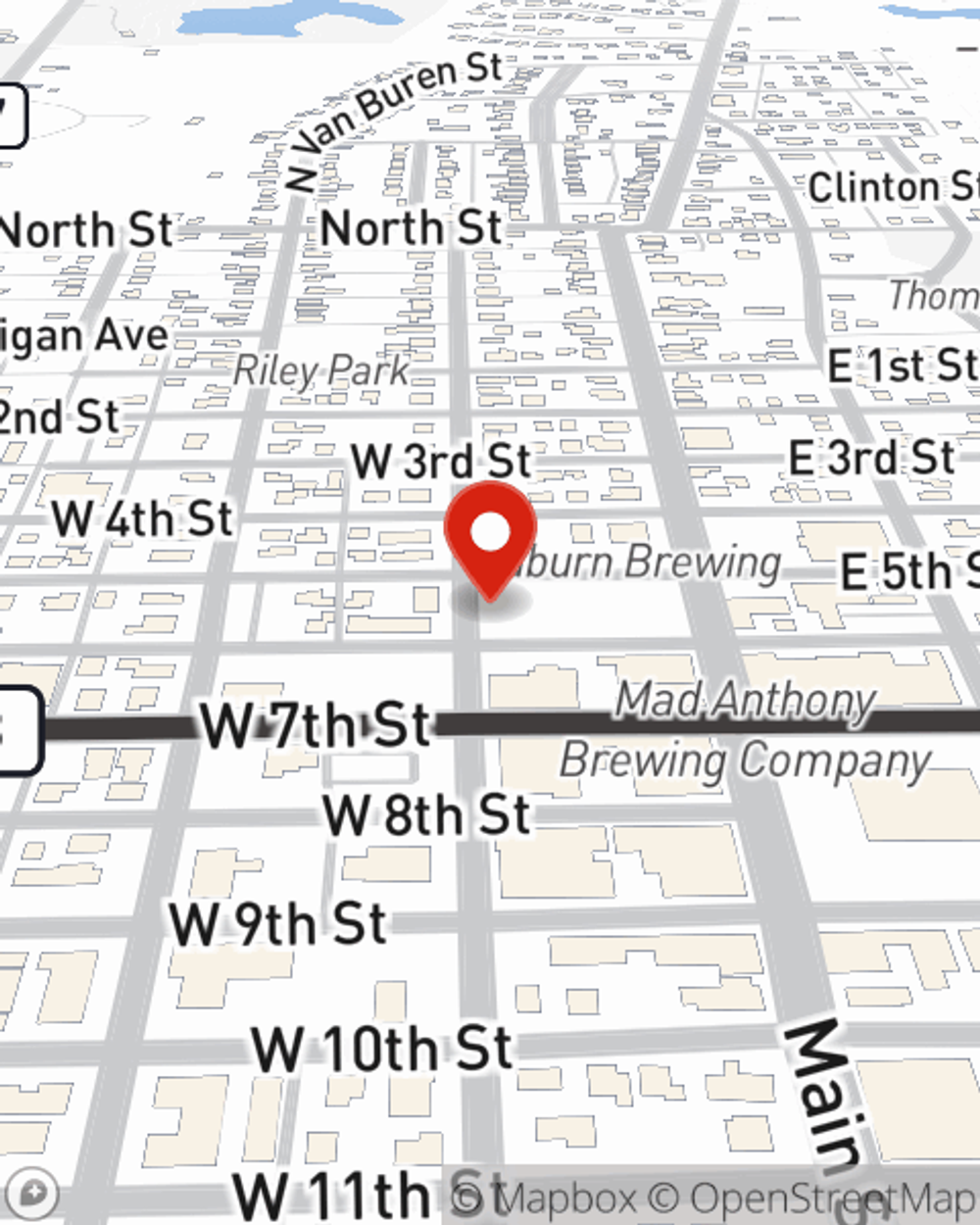

Auburn condo owners, are you ready to experience what a State Farm policy can do for you? Visit State Farm Agent Kelli Southern today.

Have More Questions About Condo Unitowners Insurance?

Call Kelli at (260) 927-8890 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Kelli Southern

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.